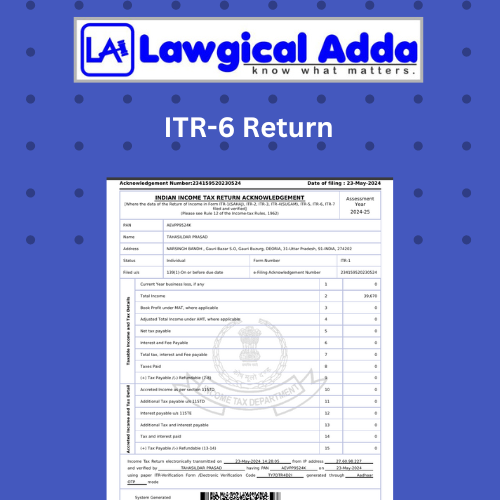

ITR-6 Return

File your Income Tax Returns with Lawgical Adda with in 4 days.

| Pricing Summary | |

| Service Price: | ₹1000 |

| GST: | ₹180 |

| Total | ₹1180 |

| Place Order | |

Have a Question?

The assessee should select the right form according to their revenue source. The ITR 6 form for businesses is one example of an Income Tax Return (ITR). This article covers all of ITR 6. The ITR-6 Form is only intended for businesses that do not claim an exemption under Section 11 while filing their income tax returns with the Indian IT department.

Companies and other organizations that receive income from property maintained for religious and charitable purposes are excluded under section 11. Correct ITR filing is crucial, particularly for large businesses. This is a step-by-step tutorial by Lawgical Adda on filing the ITR 6 form.

Who should file ITR 6?

ITR 6 Forms must be submitted by all businesses registered under the Companies Act of 2013 or the previous Companies Act of 1956. However, the firm doesn't need to file an ITR 6 Form if its revenue is derived from real estate owned for charity or religious reasons. Companies not claiming the exemption under Section 11 (Income from property held for charity or religious purposes) may use ITR-6.

Who isn't allowed to submit an ITR 6 Form?

The following list includes taxpayers not required to file an ITR-6 Form.

Companies that assert an exemption under section 11 (Income from property held for charity or religious purposes) include individuals, Hindu Undivided Family (HUF), Firms, Association of Persons (AOP), Body of Individuals (BOI), Local Authorities, and Artificial Judiciary Persons.

Steps followed by Lawgical Adda to help you submit the ITR Form 6

- Contact us through our portal. Our experts will connect with you to know your requirements.

- Send our professionals all the necessary documentation.

- Our professionals will file your income tax return online using the registered site. An ITR Filing Form will be chosen based on your category, and professionals will complete all the necessary fields and claim any relevant exemptions.

- After accounting for all exemptions, our professionals will advise you of any taxes that may be due.

- Your income tax return will then be easily filed after that.

- Lawgical Adda keeps you updated throughout the process to maintain transparency.

ITR 6 form structure

There are three sections to the ITR 6 form. Sections A, B, and their respective schedules. Each of the following details must be submitted in each of these sections:

Part A:

Private Information

Name, number, Aadhar, PAN, and other information pertaining to the entity are included in this.

Information audited

If your organization is subject to the audit, please fill out the appropriate information provided, such as the name of the auditor who signed the audit report and the date the audit report was provided.

Information about the Company

The type of business, including whether it is a holding company, a subsidiary, an original, etc. All information, including whether or not there has been an amalgamation, can be provided here.

Specifics of Important People

Here, you must list the shareholders and their shareholding pattern in addition to the company's fundamental PAN-based member information. Name, contact information, residential addresses, and other details are included.

Character of the profession and business

To file your ITR 6, you must include the codes for the three primary business or professional operations.

Equilibrium Report

Provide the balance sheet as of the fiscal year's conclusion. Here, you must provide information on your company's balance sheet, including its assets, funding sources, current liabilities, long-term loans and advances, etc.

Production Statement

This section of the form ITR-6 filing procedure contains all the information from the starting inventory to the closing stock.

Trading Account Information

This section contains details about the trading account, including gross receipts from business, profession, taxes, duties receivable, etc.

Account of Profit and Loss

This part includes the specifics of the credits and debits made to the Profit and Loss account during the fiscal year to file ITR 6.

Additional Details

When an audit is applicable, the entities must complete this part. If desired, the remaining information in this section can be omitted.

Quantitative Information

This section includes information on opening stock, purchases, sales, closing stock, and remnants for the entire year.

Method for completing sections and schedules in order

The Income Tax Department advises assesses to adhere to the order listed below when completing the income tax return.

- Part A

- Schedules

- Part B

- Verification

The Income Tax Department must receive this income tax return electronically signed by a digital signature.

When filing an ITR-6, this return form should not be filed with any other documents, not even the TDS certificate. It is urged that taxpayers reconcile their Tax Credit Statement Form 26AS with the taxes withheld, collected, and paid by them or on their behalf.

Important modifications to the ITR-6 Form for AY 2024–2025

- The Legal Entity Identifier's (LEI) details

- A new "Schedule 115TD" has been added to report the tax due on accrued income.

- Information on the Capital Gains Accounts Scheme is being disclosed.

- Revision 80GGC requests information about contributions given to political parties

- The New Schedule 80-IAC requests information about qualifying start-ups.

- New Schedule 80LA requests information regarding the IFSC or offshore banking unit.

- Disclosure of the amount owed to MSME after the deadline has passed

- Disclosure of online gaming gains subject to Section 115BBJ charges

- Reporting dividend income received from an IFSC Company unit to specify the deadline for filing a return

- Provide the audit report's acknowledgment number and the UDIN of the company identified as a micro-or small-enterprise

Date of submission of ITR-6 Form

- The Income-Tax Act stipulates that accounts must be audited by October 31 of the assessment year.

- The deadline for submitting the report in Form No. 3CEB is November 30 of the assessment year.

- In other cases (where accounts are not required to be audited), 31 July of the assessment year.

It is crucial for all companies that do not qualify for an exemption under section 11 of the Act to file their ITR 6 correctly. Still, it's always a good idea to consult professionals. You're only a click away from Lawgical Adda!